How Do You Become a Loan Signing Agent?

Becoming a loan signing agent offers a flexible and potentially lucrative career path, particularly for those interested in the real estate and mortgage industries. A loan signing agent acts as a neutral third party, ensuring loan documents are signed correctly and notarized, playing a vital role in the closing process. But how do you navigate the path to becoming a successful loan signing agent? This comprehensive guide will provide you with the necessary steps and insights to launch your career.

First, you need to understand the role. A loan signing agent isn’t a loan officer. They don’t originate loans or offer financial advice. Their primary responsibility is to facilitate the signing process, ensuring all documents are completed accurately and legally. This requires meticulous attention to detail, a professional demeanor, and a thorough understanding of the various loan documents.

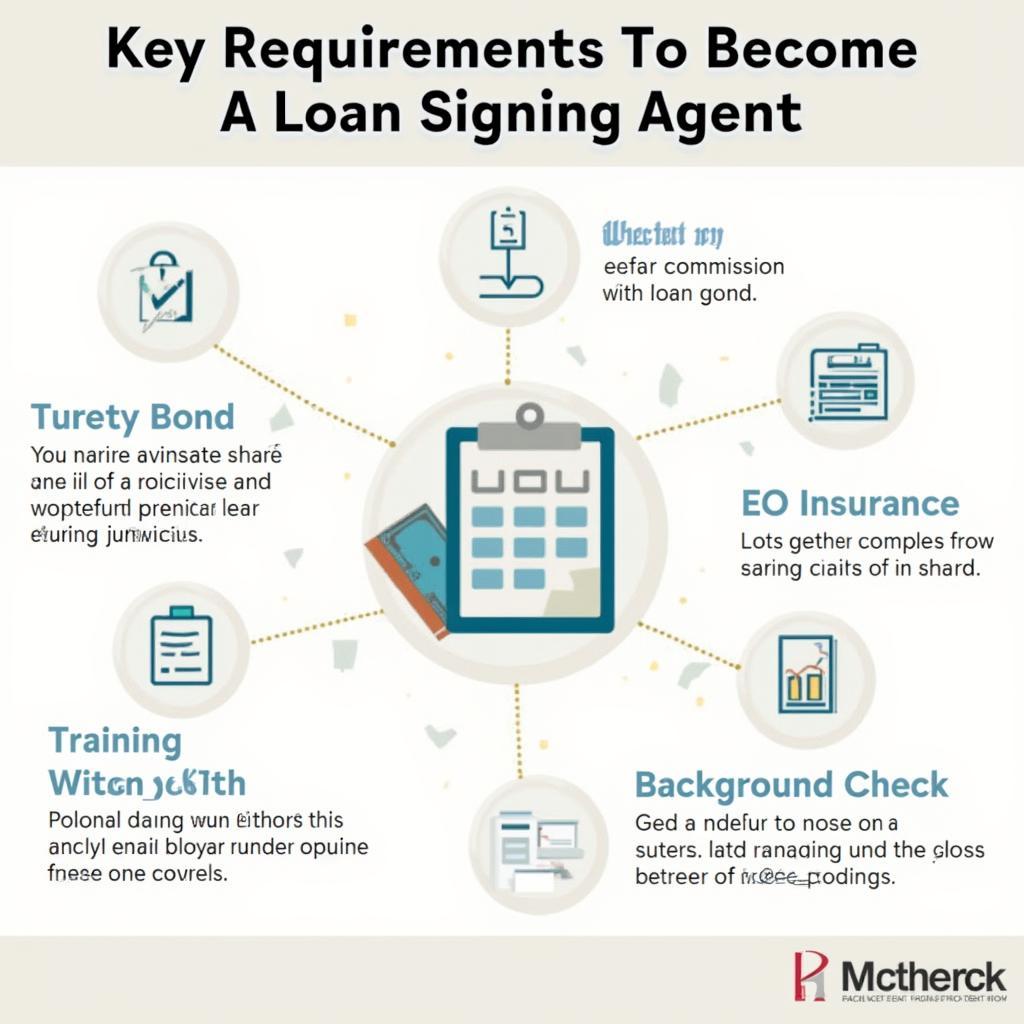

Understanding the Requirements to Become a Loan Signing Agent

The requirements to become a loan signing agent vary slightly by state, but the core elements remain consistent. You’ll need to become a commissioned notary public in your state, which typically involves an application process, background check, and passing an exam. This is crucial as notarization is a key aspect of the loan signing process. You’ll also need to obtain a surety bond, which protects signers against any errors or fraud you might commit. Errors and Omissions (E&O) insurance is also highly recommended, offering further protection against potential liabilities.

Loan Signing Agent Requirements

Loan Signing Agent Requirements

Beyond these legal requirements, investing in training specific to loan signing is essential. Several reputable organizations offer courses covering the intricacies of loan documents, closing procedures, and best practices. This training equips you with the knowledge and confidence to handle diverse loan packages and ensure a smooth closing experience. It’s also highly recommended to obtain a loan signing agent certification, which demonstrates your commitment to professionalism and expertise.

Building Your Loan Signing Agent Business

Once you’ve met the basic requirements and completed your training, it’s time to start building your business. Creating a professional website and online presence is crucial for attracting clients. Networking with title companies, escrow officers, and lenders can also generate valuable leads. Marketing your services through online directories and social media platforms can further expand your reach.

Marketing Loan Signing Agent Services

Marketing Loan Signing Agent Services

Developing strong organizational skills, maintaining accurate records, and investing in reliable transportation are also essential for success as a loan signing agent. Building a reputation for punctuality, professionalism, and accuracy is paramount. Client satisfaction is key to securing repeat business and referrals. Consider specializing in specific loan types, such as reverse mortgages or refinance loans, to further enhance your expertise and marketability.

How Much Can Loan Signing Agents Earn?

Earning potential for loan signing agents can vary depending on experience, location, and the number of signings completed. While some agents choose to work part-time, others build full-time careers with substantial income. Building a solid client base and efficient workflow are essential for maximizing your earning potential.

Loan Signing Agent Earnings Potential

Loan Signing Agent Earnings Potential

Similar to how to become a loan signing agent in ohio, the path to becoming a successful loan signing agent requires dedication, attention to detail, and a commitment to providing exceptional service. By following these steps and consistently striving for excellence, you can establish a rewarding and fulfilling career in this dynamic field.

Tips for Success as a Loan Signing Agent

- Stay updated on industry regulations and best practices.

- Invest in continuing education to enhance your skills.

- Prioritize client satisfaction and build strong relationships.

- Maintain a professional demeanor and appearance.

- Be punctual and reliable.

“Building a successful loan signing business requires meticulous attention to detail and a commitment to providing exceptional client service,” says Maria Rodriguez, a seasoned loan signing agent and industry expert.

how to become a loan signing agent in arizona offers similar insights into the requirements and process for that specific state.

“Accurate and efficient loan signings are crucial for a smooth closing process,” adds John Nguyen, a leading mortgage broker in California.

how much do loan signing agents make in california provides valuable information regarding earning potential in this specific region.

For those interested in a related career path, how to become a loan officer in nc provides helpful guidance on becoming a loan officer in North Carolina.

how to become a loan signing agent in michigan is a good resource for specific information relating to that state.

“Staying updated on industry changes and best practices is essential for maintaining a competitive edge in the loan signing field,” emphasizes Susan Lee, a renowned financial consultant.

In conclusion, becoming a loan signing agent involves meeting specific requirements, obtaining proper training, and building a strong business. By following these steps and focusing on providing exceptional service, you can establish a successful and rewarding career as a loan signing agent. Start your journey today and become a vital part of the real estate and mortgage industry.