Finding the Right Lloyds Bank Loans Address: A Comprehensive Guide

Lloyds Bank offers a variety of loan options, and knowing the right Lloyds Bank loans address can be crucial for your application process. This guide provides valuable information regarding Lloyds Bank loans, helping you understand the process and make informed decisions.

Navigating the loan application process can be daunting, especially with a large institution like Lloyds Bank. This guide clarifies the different ways to find the relevant Lloyds Bank loans address, whether for general inquiries, specific loan applications, or branch locations. Understanding the different contact points can significantly streamline your experience. From online applications to in-person branch visits, we cover all the bases. Moreover, we’ll delve into the types of loans Lloyds Bank offers, helping you choose the best fit for your financial needs.

Understanding Your Loan Needs and Lloyds Bank Offerings

Before searching for a Lloyds Bank loans address, it’s essential to identify your specific needs. Are you looking for a personal loan, a mortgage, a car loan, or a business loan? Each loan type has different requirements and application processes. Lloyds Bank provides a wide range of loan products, catering to diverse financial needs. Understanding their offerings will help you target your search for the correct address.

Personal Loans: Options and Considerations

Personal loans from Lloyds Bank can be used for a variety of purposes, from home improvements to debt consolidation. Knowing the specifics of these loans, like interest rates and repayment terms, is crucial before applying. This information can often be found online, but contacting Lloyds Bank directly can provide personalized guidance.

Mortgages with Lloyds Bank: Finding the Right Path

Mortgages are a significant financial commitment, and finding the right Lloyds Bank loans address for mortgage inquiries is paramount. Whether you’re a first-time buyer or looking to remortgage, contacting a specialized mortgage advisor can save you time and effort. Lloyds Bank has dedicated mortgage departments, and knowing their specific address can be beneficial.

Business Loans: Fueling Your Enterprise

For business owners, Lloyds Bank offers various business loan options. These loans can be instrumental in expanding operations, purchasing equipment, or managing cash flow. Finding the right Lloyds Bank loans address for business lending is essential for accessing these vital resources. Often, a dedicated business banking center will handle these loan applications.

Lloyds Bank Business Loan Options

Lloyds Bank Business Loan Options

Locating the Correct Lloyds Bank Loans Address

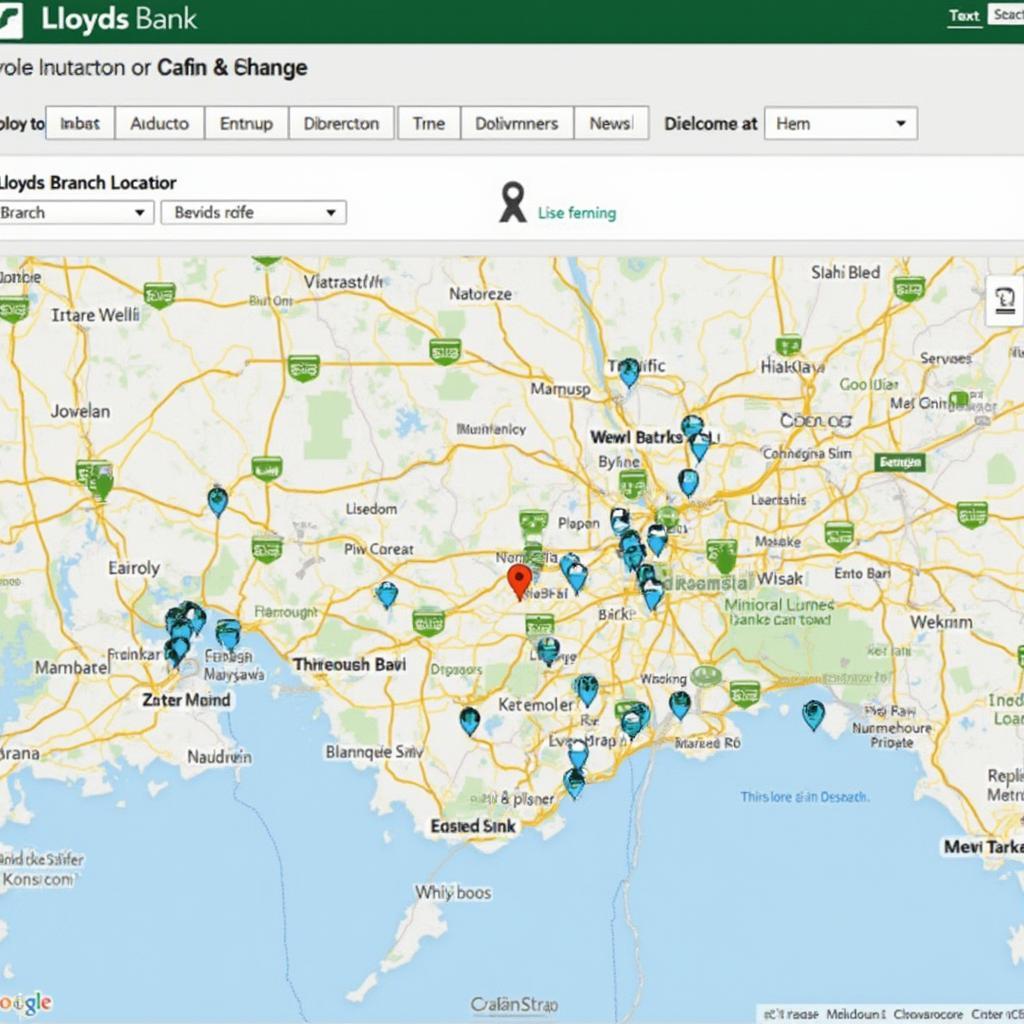

There are several ways to find the appropriate Lloyds Bank loans address. Their website provides a branch locator tool, enabling you to find the nearest branch to your location. For general inquiries, you can also use their online contact form or call their customer service line.

Using Online Resources: A Quick and Convenient Approach

The Lloyds Bank website offers a wealth of information, including FAQs, loan calculators, and contact details. You can often find specific email addresses or online application portals for various loan types. This is a convenient way to begin your loan journey.

Contacting Customer Service: Direct Assistance

Calling Lloyds Bank’s customer service line can connect you with a representative who can answer your questions and direct you to the appropriate department or branch. This personal interaction can be particularly helpful for complex inquiries.

Visiting a Branch: In-Person Support

For those who prefer face-to-face interaction, visiting a local Lloyds Bank branch can provide personalized assistance. You can discuss your loan needs with a bank advisor and obtain application forms. Remember to check the branch’s opening hours before your visit.

Locating a Lloyds Bank Branch

Locating a Lloyds Bank Branch

Ensuring a Smooth Loan Application Process

Once you have the correct Lloyds Bank loans address, ensure you have all the necessary documentation, such as proof of income, identification, and address verification. Having these documents prepared can expedite the application process.

how can i reduce my total loan cost

Conclusion

Finding the right Lloyds Bank loans address is the first step towards securing the financial assistance you need. By understanding your needs, researching Lloyds Bank’s offerings, and utilizing the available resources, you can navigate the loan application process efficiently and effectively. Begin your journey towards financial well-being today by contacting Lloyds Bank.

FAQ

- What types of loans does Lloyds Bank offer?

- How can I find the nearest Lloyds Bank branch?

- What documents do I need for a loan application?

- How can I contact Lloyds Bank customer service?

- What are the interest rates for personal loans?

- Does Lloyds Bank offer online loan applications?

- How can I check the status of my loan application?