Loans Quincy IL: Your Guide to Secure Borrowing

Finding the right loan in Quincy, IL can be challenging. Navigating the various options, interest rates, and lending terms requires careful consideration. This guide will provide you with valuable insights into the loan landscape in Quincy, IL, helping you make informed decisions and secure the financing you need.

Understanding the different types of loans available is crucial. From personal loans for debt consolidation to auto loans for your next vehicle, knowing the specifics of each loan type will empower you to choose the best fit for your financial situation. Factors like credit score, income, and existing debt play a significant role in determining loan eligibility and interest rates.

Types of Loans in Quincy IL

Several loan options cater to diverse needs in Quincy, IL. Let’s explore some of the most common types:

Personal Loans

Personal loans offer flexibility and can be used for various purposes, including debt consolidation, home improvements, or unexpected expenses. These loans typically have fixed interest rates and repayment terms.

Auto Loans

Auto loans specifically finance vehicle purchases. Lenders in Quincy, IL offer competitive rates and terms for both new and used cars. title loans quincy il are another option to consider for car financing.

Mortgage Loans

Mortgage loans enable individuals to purchase homes. Quincy, IL has a range of mortgage options, including fixed-rate, adjustable-rate, and FHA loans.

Applying for a Loan in Quincy Illinois

Applying for a Loan in Quincy Illinois

Small Business Loans

Small business loans provide funding for entrepreneurs and established businesses in Quincy, IL. These loans can be used for expansion, equipment purchases, or working capital.

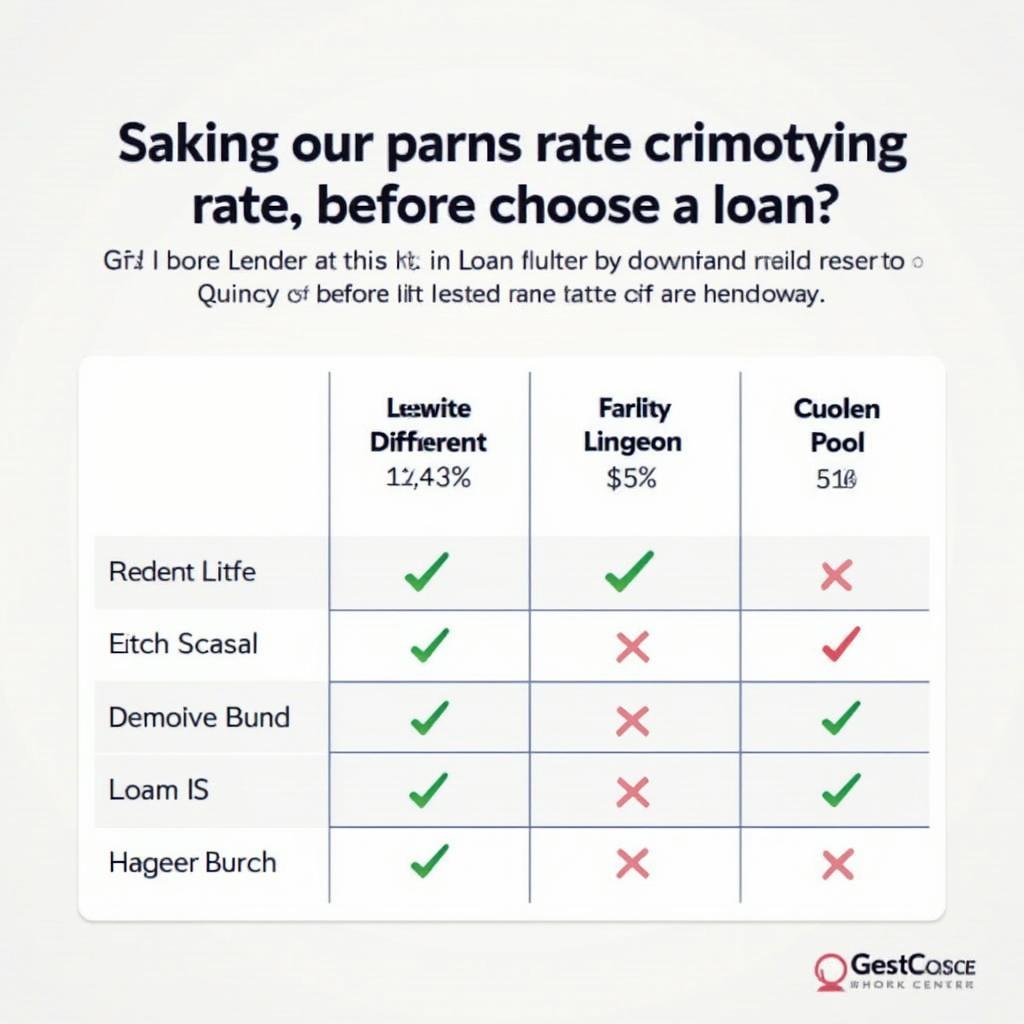

Finding the Right Lender in Quincy IL

Choosing the right lender is as important as selecting the right loan type. Research different lenders in Quincy, IL, comparing their interest rates, fees, and customer reviews. Consider local banks, credit unions, and online lenders.

Credit Unions

Credit unions often offer personalized service and competitive rates to their members.

Online Lenders

Online lenders provide convenient online applications and quick loan processing.

Banks

Banks offer a wide range of loan products and services, catering to various financial needs.

Comparing Loan Rates in Quincy, IL

Comparing Loan Rates in Quincy, IL

Tips for Securing a Loan in Quincy IL

Improving your credit score, maintaining a stable income, and managing your debt responsibly will increase your chances of loan approval and secure favorable terms. It is also essential to borrow responsibly and ensure you can comfortably afford the monthly payments. Explore options like how to get out of a car title loan if you are struggling with existing title loan payments.

“A strong credit score is a key factor in loan approval,” says John Miller, a financial advisor at Quincy Financial Solutions. “Taking steps to improve your creditworthiness will significantly benefit your loan application process.”

What are the common loan terms in Quincy, IL?

Loan terms vary depending on the type of loan and lender. Common terms include loan amount, interest rate, repayment period, and fees.

How do I apply for a loan in Quincy, IL?

Most lenders offer online applications, providing a convenient and efficient way to apply for a loan. You will typically need to provide personal and financial information, such as your income, employment history, and credit score.

“Understanding the loan terms and conditions thoroughly is crucial before signing any agreement,” advises Maria Sanchez, a senior loan officer at First Quincy Bank. “Make sure you are comfortable with the repayment schedule and associated fees.”

In conclusion, navigating the loan landscape in Quincy, IL requires careful planning and research. By understanding the different loan types, researching lenders, and improving your financial standing, you can confidently secure the financing you need to achieve your financial goals. Remember to compare loan options and choose the best fit for your individual circumstances.

FAQ

- What is the average interest rate for personal loans in Quincy, IL?

- What documents are required to apply for a mortgage loan in Quincy, IL?

- How long does it take to get approved for a car loan in Quincy, IL?

- Are there any government-backed loan programs available in Quincy, IL?

- What are the penalties for late loan payments?

- Can I prepay my loan without penalty?

- How can I improve my credit score to qualify for a loan in Quincy, IL?