Student Loans to Apply for Without a Cosigner

Navigating the world of student loans can be daunting, especially if you’re looking for options without a cosigner. Finding the right student loan without a cosigner requires careful research and consideration of various factors. This guide will explore the options available, eligibility requirements, and strategies to secure funding for your education.

Understanding Student Loans Without a Cosigner

Student loans without a cosigner allow students to borrow money for educational expenses independently, without requiring a guarantor. These loans can be a lifeline for students who lack access to traditional cosigner options. These loans typically rely heavily on the borrower’s creditworthiness and financial stability.

Types of Student Loans Available Without a Cosigner

Several types of student loans can be accessed without a cosigner, each with its unique features and eligibility criteria. Understanding these differences is crucial in making an informed decision.

- Federal Student Loans: These are government-backed loans offering several benefits, including fixed interest rates and income-driven repayment plans. However, securing these without a cosigner can be challenging for those with limited credit history.

- Private Student Loans: Offered by private lenders, these loans often come with higher interest rates and stricter eligibility requirements. However, some lenders specialize in providing loans to students without cosigners, focusing on factors beyond traditional credit scores.

- Merit-Based Loans: Some institutions and organizations offer merit-based loans, which focus on academic achievements rather than credit history. These can be an excellent option for high-achieving students with limited financial resources.

Federal Student Loans Without a Cosigner

Federal Student Loans Without a Cosigner

Qualifying for a Student Loan Without a Cosigner

While securing a student loan without a cosigner can be more challenging, it’s certainly achievable with the right approach. Lenders typically assess several factors when evaluating applications.

- Credit Score: A strong credit score demonstrates responsible financial behavior and increases your chances of loan approval. Building credit through secured credit cards or becoming an authorized user on a family member’s account can be helpful.

- Income and Employment History: A stable income and consistent employment history can assure lenders of your ability to repay the loan. Providing documentation such as pay stubs and tax returns can strengthen your application.

- Academic Performance: Strong academic performance can sometimes influence loan eligibility, especially for merit-based loans. Maintaining a good GPA and demonstrating commitment to your education can be beneficial.

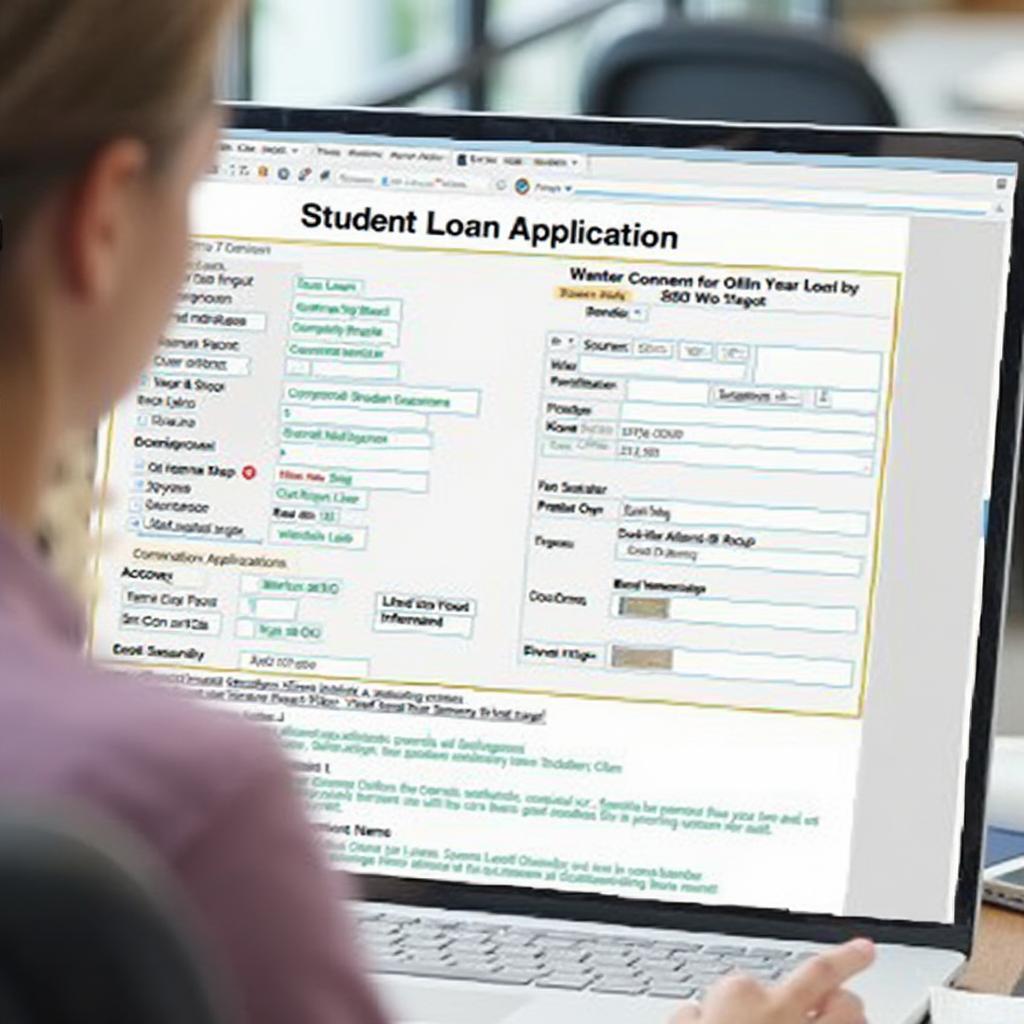

Student Loan Application Without a Cosigner

Student Loan Application Without a Cosigner

Tips for Applying for Student Loans Without a Cosigner

Successfully applying for a student loan without a cosigner requires a strategic approach. Here are some essential tips to increase your chances:

- Research Lenders Thoroughly: Explore various lenders and compare their interest rates, loan terms, and eligibility criteria. Focus on lenders who specialize in loans for students without cosigners.

- Build a Strong Credit History: If possible, work on improving your credit score before applying. This can significantly increase your chances of approval and potentially secure better loan terms.

- Provide Complete and Accurate Information: Ensure your application is complete and accurate, providing all necessary documentation to verify your income, employment, and academic history.

- Explore Scholarship Opportunities: Scholarships and grants can significantly reduce your reliance on loans. Thoroughly research available opportunities and apply for those you qualify for.

- Consider Alternative Funding Options: Explore alternative funding options like crowdfunding or income-share agreements, especially if securing a traditional loan proves challenging.

Student Loan Approval Without a Cosigner

Student Loan Approval Without a Cosigner

“Building a solid credit history is crucial for securing a student loan without a cosigner. Start early and focus on responsible financial habits.” – Nguyen Thi Lan Anh, Certified Financial Planner

“Don’t limit your search to traditional lenders. Explore alternative funding options and scholarship opportunities to minimize your borrowing needs.” – Tran Van Minh, Student Loan Advisor

Conclusion

Securing student loans to apply for without a cosigner requires careful planning and effort. By understanding the available options, eligibility criteria, and applying these tips, you can increase your chances of securing the necessary funding to achieve your educational goals. Remember to research thoroughly, build a strong credit history, and explore all available avenues. Your future self will thank you for the informed decisions you make today.

FAQ

-

What is the minimum credit score required for a student loan without a cosigner? The minimum credit score varies depending on the lender and loan type. Some lenders may consider applicants with lower scores, while others require higher scores.

-

Can international students get student loans without a cosigner? Some lenders specialize in loans for international students without cosigners. Eligibility criteria vary, and additional documentation may be required.

-

What happens if I can’t find a cosigner for my student loan? If finding a cosigner is not possible, explore federal loan options, build your credit, research private lenders specializing in no-cosigner loans, and consider alternative funding sources.

-

How can I improve my chances of getting approved for a private student loan without a cosigner? Focus on building a strong credit history, maintaining a stable income and employment record, and achieving good academic performance.

-

Are there any income requirements for student loans without a cosigner? Lenders may have income requirements to ensure borrowers can repay the loan. Specific requirements vary depending on the lender and loan amount.

-

What are the repayment options for student loans without a cosigner? Repayment options vary depending on the loan type. Federal loans offer income-driven repayment plans, while private loans typically have standard or graduated repayment plans.

-

What are the interest rates for student loans without a cosigner? Interest rates vary widely based on the lender, loan type, and borrower’s creditworthiness. Generally, private loans without cosigners may have higher interest rates than federal loans or private loans with cosigners.